Long Term Care Resources

Pacific Agency

Prepare for peace of mind.™

LONG TERM CARE INSURANCE, LIFE INSURANCE, AND BEYOND

Our Services

Why LTCR

Long-Term Care Resources (LTCR) is a national insurance agency dedicated to long-term care insurance and the senior market. We are one of the leading, independent long-term care insurance distributors in the country and have partnered with many universities, professional organizations, and businesses to offer competitive long term care insurance rates with outstanding coverage. Since our founding in 1997, we have helped over half a million members with their long-term care planning needs.

Frequently Asked Questions

What is Long Term Care Insurance?

Long Term Care Insurance (LTCI) is a specialized insurance product designed to cover the costs associated with long-term care services, which typically are not covered by standard health insurance, Medicare, or Medicaid. Long-term care encompasses a wide range of services and supports for individuals who require assistance with everyday activities or supervision due to a chronic illness, disability, aging, or other conditions.

Why Do I Need Long Term Care Insurance?

In 2024, the cost of long-term care varies significantly based on the type of care required. For assisted living, the estimated median cost is around $4,917 per month, while for a private room in a nursing home, the cost is approximately $9,872 per month.

Without insurance, individual costs can be substantial. Home health aides average about $5,148 monthly, adult day care is approximately $1,690 per month, assisted living facilities cost around $4,500 per month, a semi-private room in a nursing home is about $7,908 per month, and a private room in a nursing home averages $9,034 per month. It’s also important to note that these are median costs, and actual expenses can vary based on location, level of care required, and specific amenities offered by the care facility.

Long term care insurance helps to mitigate these costs considerably, placing less burden on both your finances and your family.

How Much Long Term Care Insurance Do I Need?

Every individual has different needs, reflecting their own personal preferences about the type and level of care they hope to receive along with their other income sources. We encourage you to contact us to discuss policy options. Our insurance agents make every effort to accurately assess your financial needs and work with you to come up with the right policy for you.

How Much Does Long Term Care Insurance Cost?

That depends on the amount of the policy, your age, and many other factors. It may be as little as $100 or much more. The earlier you obtain long term care insurance, the less it typically costs. Contact LTCR Pacific to speak to one of our agents and learn more about your expected costs.

Meet Our Team of Insurance Experts

LTCR Pacific has an incredible team of insurance agents that specialize in long term care insurance and span coverage over 30 states. With a combined 200+ years of experience, our team is ready to assist you in your life and health goals.

Looking for a Long Term Care Insurance Agent?

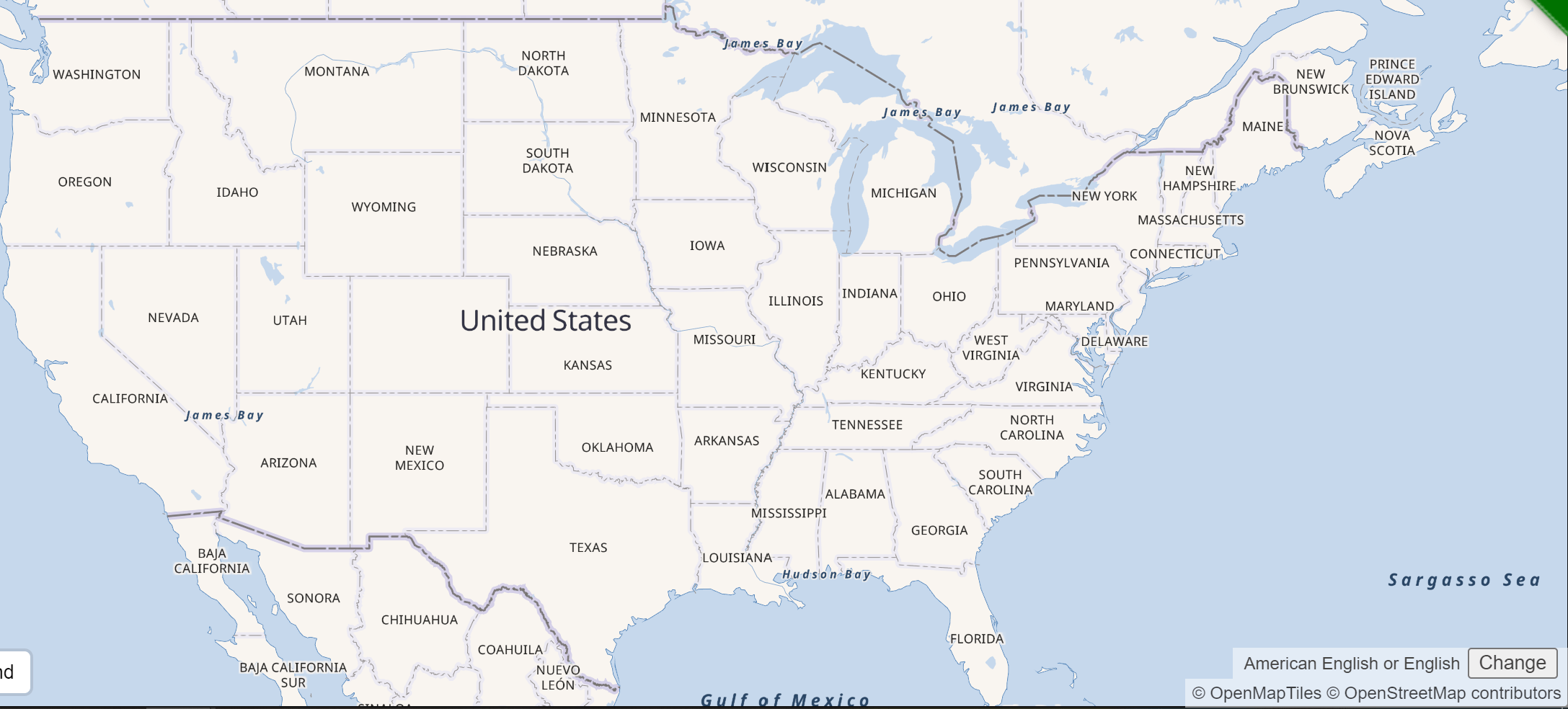

Our agents are licensed in multiple states, allowing us to provide you with life insurance, long term care insurance, Medicare insurance, and many other forms of coverage. Click on the map below to find the agents licensed in your state, or contact us directly to get connected to someone that can offer you the best possible support for your region.

Our agents are spread out around the United States, so if you’re looking for someone local, please give us a call and we will connect you to someone that can help.

We'd Love To Hear From You

contact us

Find us Here

- 100 E. Thousand Oaks Blvd, Suite 186 Thousand Oaks, CA 91360

We are here to help

Contact a licensed Long-Term Care Insurance Specialist today on (800) 499-0067 to learn more about Long-Term Care and other forms of insurance.